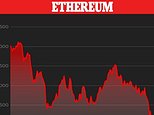

Ethereum joins crypto plunge: Second largest digital currency loses 20% of its value in 24 hours

Ethereum joins the cryptocurrency plunge: Second largest digital currency loses 20% of its value in 24 hours as Coinbase warns customers they may lose ALL their money

Ethereum has plunged 20 per cent in 24 hours as part of the latest crypto crashBitcoin has also plunged 11.24 per cent as investors suffer heavy lossesLuna, another large cryptocurrency, lost almost all of its value overnight Despite the downturn, traditional tech stocks are faring even worseAmazon has lost 30 per cent of its value in just one month of trading

<!–

<!–

<!–<!–

<!–

(function (src, d, tag){

var s = d.createElement(tag), prev = d.getElementsByTagName(tag)[0];

s.src = src;

prev.parentNode.insertBefore(s, prev);

}(“https://www.dailymail.co.uk/static/gunther/1.17.0/async_bundle–.js”, document, “script”));

<!–

DM.loadCSS(“https://www.dailymail.co.uk/static/gunther/gunther-2159/video_bundle–.css”);

<!–

The world’s second largest cryptocurrency Ethereum has joined the cryptocurrency crash – plummeting in value by 20 per cent over the last 24 hours – as the digital currency downturn hammers investors who bought during the Covid years.

Cryptocurrencies have sharply declined in value during the past few days as fears for the global economy spread and investors start to sell off risky assets.

However investors in more traditional stocks are also hurting, with US tech stocks also plunging in recent weeks including Amazon which has fallen 30 per cent in a month.

Many amateur investors took to buying stocks and digital currencies during the Covid pandemic and made money because values were generally rising in a so-called bear market.

Ethereum has now lost more than half of its value this year, Bitcoin has shed a third of its value since January and Luna with 98 per cent of its value wiped out overnight with suicide hotlines pinned to the currency’s Reddit page as a result.

Popular digital currency exchange Coinbase warned users could lose all of their money if the company goes bankrupt – after the downturn led to a 27 per cent fall in its share price.

Stablecoins are digital tokens pegged to the value of traditional assets, such as the U.S. dollar which are supposed to be less volatile than other cryptocurrencies like Bitcoin.

Stablecoins like Luna are popular in times of turmoil in crypto markets and are often used by traders to move funds around and speculate on other cryptocurrencies.

Luna lost its pegging to the dollar this week, falling below $1 per coin, causing prices to drop dramatically as the industry panicked (similar to a run on a bank).

‘The Terra incident is causing an industry-based panic, as Terra is the world’s third-biggest stable coin,’ said Ipek Ozkardeskaya, a senior analyst at Swissquote Bank.

But TerraUSD ‘couldn’t hold its promise to maintain a stable value in terms of U.S. dollars.’

The crypto downturn has wiped more than $1.5trillion of value from the markets but investors will still be hoping that prices will be able to recover as they have done in the past.

However, unlike previous crashes, experts think that this latest drop in prices is due to broader fears about global recession.

Despite previous rallies, analysts fear that the ‘party may be over’ for cryptocurrencies.

The NASDAQ experienced its sharpest one-day fall since June 2020 earlier this week and the crypto hit implies an increasing integration between crypto and traditional markets.

The amount of business done by crypto exchanges, which hold the ‘blockchain’ ledgers that record transactions, is also dropping heavily.

‘The crypto sell-off has been driven by the daunting macro backdrop of rising inflation and interest rates that has sent shockwaves through the tech sector, dragging cryptos down with it, confirming that Bitcoin and others serve little purpose as a hedge against inflation,’ said Victoria Scholar, head of investments at Interactive Investors.

A perfect storm of circumstances, not least a looming fall in tech stocks that many fear will turn into a historic crash, has led to predictions that we are about to see another repetition of the fate of the dotcom boom.

And cryptocurrencies are slap bang in the firing line — along with a spin-off fad for digital art, known as NFTs, or non-fungible tokens.

Rising interest rates around the world are a major part of crypto’s problem. The pandemic was a golden time for cryptocurrencies, as central banks pushed interest rates down to record levels to boost economies.

This low propelled investors to look for assets that provided a healthy rate of return and many inevitably targeted Bitcoin and its rivals, dubbed altcoin.

Now that interest rates are rising, investors can make better returns buying global government bonds — which are less risky than crypto.

The downturn has led to Coinbase, an online trading platform, issuing a stark warning to customers: Your crypto is at risk if the exchange goes bankrupt.

According to Coinbase’s official website, the company has more than 98 million verified users. It is the largest cryptocurrency exchange platform in the United States.

Coinbase’s CEO Brian Armstrong attempted to calm shareholders in a series of tweets one of which read: ‘Your funds are safe at Coinbase, just as they’ve always been.’

Despite Armstrong’s claims, in an SEC filing the company referred to customers as ‘unsecured creditors’ in the event that Coinbase went belly-up.

This means that customers’ crypto assets would be considered the property of Coinbase by bankruptcy administrators.

The SEC filing, Staff Accounting Bulleting 121, requires crypto platforms to include customer’s crypto holdings as assets and liabilities on balance sheets.

Armstrong wrote on Twitter that the company is at ‘no risk of bankruptcy’ despite the filing, which he said was made so that company would be in compliance with SEC regulations.

![]()